The BoJ Law of 1942 set out the major objective of the BoJ as assisting economic growth. During Japan’s Economic Miracle years (from about 1950 to 1975) the BoJ enabled Japanese economic growth by acting under Government control and creating no-cost investment credit (with a targeted effect of between 10% to 15% of GDP a year) with the objective of increasing the percentage of national investment in plant and equipment in private industry.

“

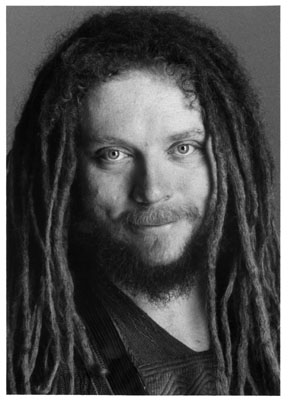

Japan’s most influential post-war economist” was Dr Osamu Shimomura (1910-89). Shimomuran Economics is based upon no-debt Investment Credit Creation at the BoJ, where created credit is distributed to all businesses (including millions of SMEs) through the national banking system to long-term, low-cost loans for private industry in every part of the country, creating a lasting boom in capital investment and widespread prosperity as evidenced by high, continually increasing productivity, in a nearly full employment economy with increasing wages and good social benefits.

Dr Osamu Shimomura’s model replaces the I=S Keynesian Investment-Saving equation in his “Model of the Japanese Economy” (Shimomura, 1961) with the more dynamic equation:

Is +Id = S+D

where Is= Investment financed by Saving, and Id = Investment financed by Debt, and where S=Saving and D=Debt

This is the prime equation for an economy in which investment vastly exceeds saving due to investment credit creation. That central equation of Shimomuran Economics is the natural development from Keynes’ observations, as follows:

i) “While there are intrinsic reasons for the shortage of land, there are no intrinsic reasons for the shortage of capital” (Keynes, 1936, p. 376)

ii) “Saving can be created in advance of the return on investments which justify it..”

These observations are fundamental to the practice of Shimomuran economics. Or as Kenneth Bieda has written: “The Japanese monetary policy, in fact, applied one of the Keynesian principles: saving does not have to precede investment in conditions where there is unemployment, but investment acts financed by bank-created money can precede savings" (Beida, 1970).

iii) Central Banks can purchase no-debt assets by making claims against themselves - In the “Tract on Monetary Reform”, Keynes recognised that a Central Bank “may itself purchase assets, i.e. add to its investments, and pay for them, in the first instance at least, by establishing a claim against itself” (Keynes, 1923).

This is precisely what the Central Banks of all the “economic miracle” countries have done (the USA 1938-44, Japan 1946-75, China mid-1970s to now) and they did not only do this in the first instance but, in the case of Japan and China persisted in that policy over several decades, as a deliberate act of long-term economic policy. These created credits have a repayment schedule, so they are CB assets, and no borrowing to support them is necessary, but a fictional entry of “savings of the people” is usually generated to preserve the double-entry nature of national bookkeeping. As John Kenneth Galbraith observed “the creation of money is so simple that the mind is repelled”.

Keynes’ writings are like a box of fireworks and not just the single-rocket solution to deficient demand in which the neoclassicists have boxed him. The economist Professor Richard Andreas Werner, has proven that the Japanese BoJ credit creation has a Granger Predictive Causality linkage to subsequent economic growth (Werner, 2005). Shimomuran economics is not, as so many neo-classical economists have told me over decades, just based on a correlation but is now founded on a Granger Causative proof - that higher investment credit produces subsequent higher growth.

Shimomuran economics has the same credit-creating principles as the Rooseveltian economics which won the Second World War for the Allies by producing the explosive economic growth of America from 1938-44, when the USA doubled its economic output. It is the understandings set out in his seminal book “Seicho Seisaku No Kihon Mondai” which propelled Japan, in the course of a few decades, from being an impoverished war-damaged economy into one of the major industrial economies of the world. China’s adoption of Shimomuran economics from the mid 1970s has produced the largest economic miracle and potentially the major preponderant superpower of the 21st century.

The relevance of the Shimomuran Economic Model Today

According to the

DBJ, Dr Osamu Shimomura (1910-89) “rose to become Japan’s most influential post war economist, founding a school of thought based on the “Shimomura Theory,” which attracted numerous followers" and "Dr Shimomura was well known for the development of a theory of economic growth based on a dynamic view of Keynesian economics.”Yet Shimomura’s works have been almost totally ignored by Western economists.

In brief, Shimomuran economics, by providing abundant capital:

a) Enables full employment and thus can tap all of the available human ingenuity in the economy

b) Improves labour productivity through higher investment in new and existing facilities

c) Provides upskilling of the workforce through training

d) Funds higher invention and R&D

e) Funds innovation and increases economic growth

f) Assists government by providing the capital funds for major projects and to provide the restorative capital required in the aftermath of national disasters

Abundant no-cost investment capital solves many of the economic problems of the world. As the master growth economist Dr Kenneth Kenkichi Kurihara has concluded with respect to the Shimomuran Model of Economic Growth:

“If, therefore, greater investment can be financed partly by credits, there is no need for that 'abstinence' which the classical economists considered necessary for economic progress, any more than there is for that 'austerity' which some present day underdeveloped countries impose on already under-consuming populations at the constant peril of social unrest. Nor is it difficult, in such credit-creating circumstances, to agree with Keynes' observation that investment and consumption should be regarded as complementary rather than competitive." (Kurihara, 1963, p. 61).

Why have Western Economists Ignored Shimomura?

The works of Shimomura are not generally available in the West, although the Library of Congress has many of his works and the National Library of Scotland has successfully acquired three of the eight which I asked them to acquire. The

only English translation of one of Shimomura’s books ("Basic Problems of Growth Policy" 1961) has been provided by the Indian Statistical Unit at Kolkata.

If Western Economists have ignored Shimomura to date, then perhaps it is time to grant him his proper place as one of the world’s greatest economists. Judging by the great prosperity and history-tilting results his insights have produced so far, he should be placed where he belongs, among the giants of economic understanding.

Bibliography

Beida, K. (1970) "The Structure and Operation of the Japanese Economy" John Wiley and Sons Australasia Pty Ltd, Sydney

Keynes, J.M. (1923) "Tract on Monetary Reform"

Keynes, J.M. (1936) “The General Theory, Book 6, Chapter 24, Section 2

Kurihara (1963) Applied Dynamic Economics, George Allen and Unwin, London

Shimomura, O. (1961), “Seicho Seisaku No Kihon Mondai” (Basic Problems of Growth Policy)

Werner, R.A. (2005) “"New Paradigm in Macro-Economics” Chapter 15